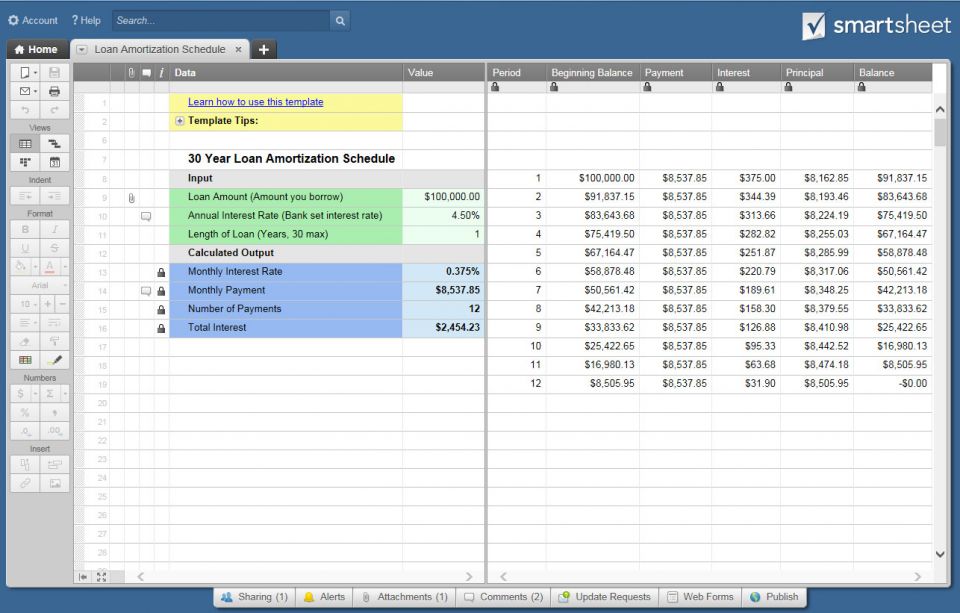

To calculate the principal part of each periodic payment, use this PPMT formula: This formula goes to C8, and then you copy it down to as many cells as needed: This argument is supplied as a relative cell reference (A8) because it is supposed to change based on the relative position of a row to which the formula is copied. To find the interest part of each periodic payment, use the IPMT(rate, per, nper, pv,, ) function:Īll the arguments are the same as in the PMT formula, except the per argument that specifies the payment period. Please pay attention, that we use absolute cell references because this formula should copy to the below cells without any changes.Įnter the PMT formula in B8, drag it down the column, and you will see a constant payment amount for all the periods: Putting the above arguments together, we get this formula: The fv and type arguments can be omitted since their default values work just fine for us (balance after the last payment is supposed to be 0 payments are made at the end of each period).For the pv argument, enter the loan amount ($C$5).Nper - multiply the number of years by the number of payment periods per year ($C$3*$C$4).Rate - divide the annual interest rate by the number of payment periods per year ($C$2/$C$4).

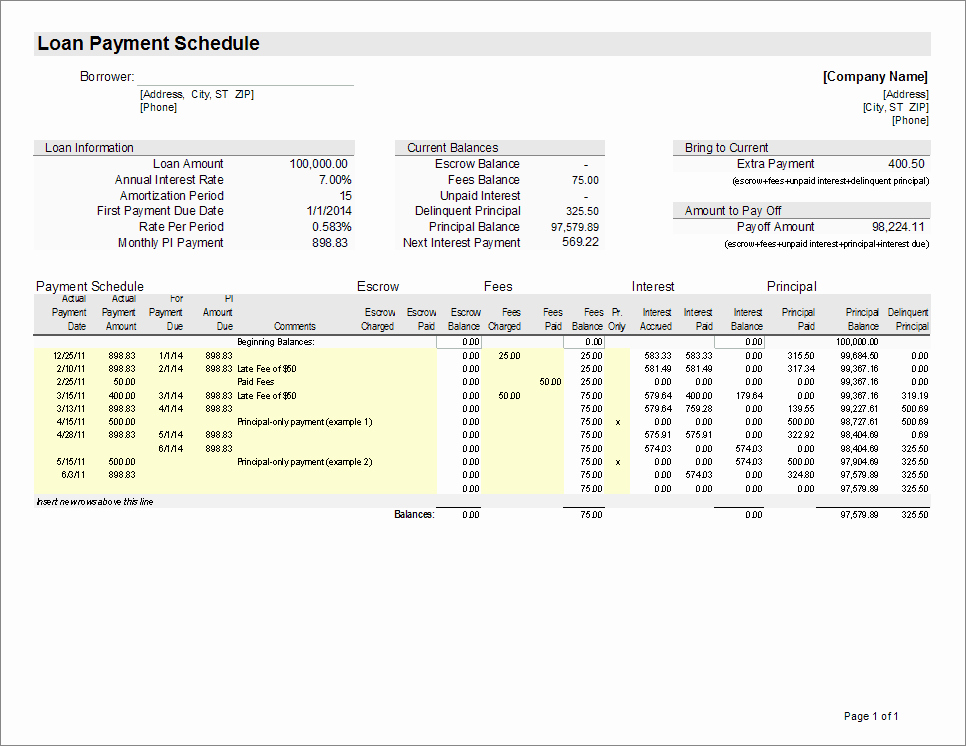

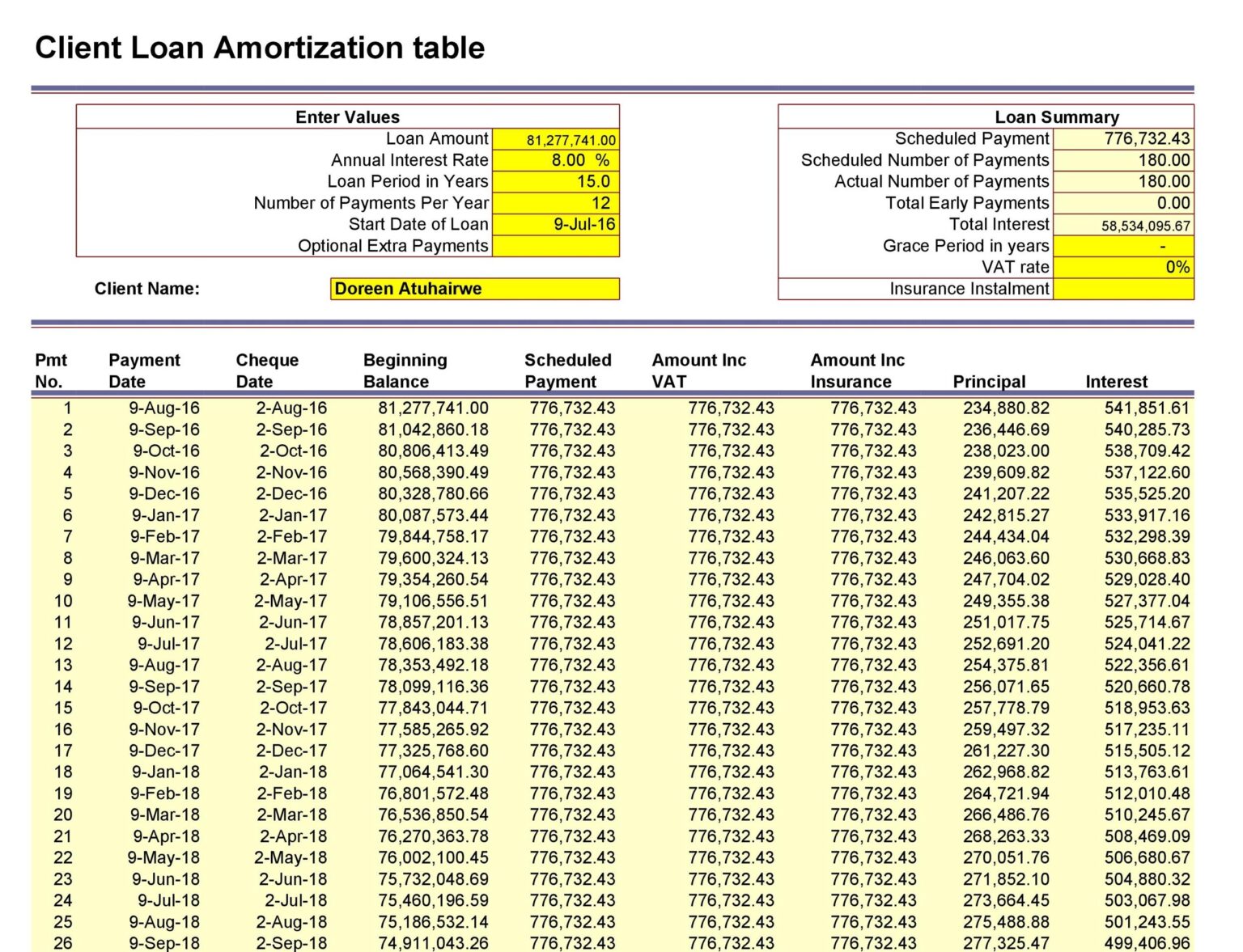

To handle different payment frequencies correctly (such as weekly, monthly, quarterly, etc.), you should be consistent with the values supplied for the rate and nper arguments: The payment amount is calculated with the PMT(rate, nper, pv,, ) function. Calculate total payment amount (PMT formula) With all the known components in place, let's get to the most interesting part - loan amortization formulas.Ģ. In the Period column, enter a series of numbers equal to the total number of payments (1- 24 in this example): The next thing you do is to create an amortization table with the labels ( Period, Payment, Interest, Principal, Balance) in A7:E7. Set up the amortization tableįor starters, define the input cells where you will enter the known components of a loan: Now, let's go through the process step-by-step.

This amount increases for subsequent payments.

To build a loan or mortgage amortization schedule in Excel, we will need to use the following functions: How to create a loan amortization schedule in Excel

0 kommentar(er)

0 kommentar(er)